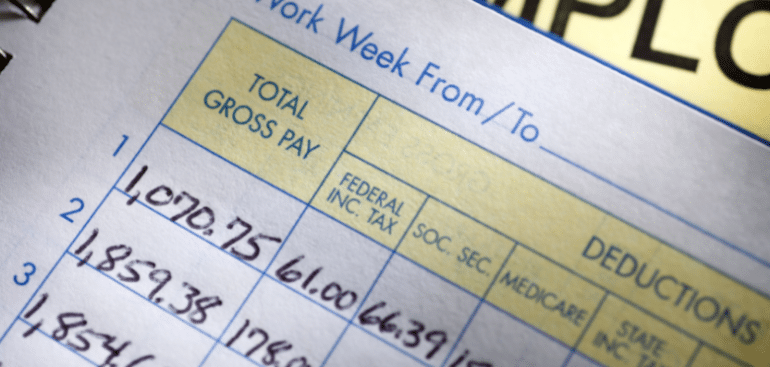

Under real time information (RTI), employers are required to report pay and deductions information to HMRC ‘at or before’ the time that the payment is made to the employee. This is done by means of the full payment submission (FPS).

Read More

All business must start at some point, and a furnished holiday lets (FHLs) business is no exception. Unlike other rental properties, furnished holiday lettings enjoy special tax rules. As a result, they are able to benefit from capital gains tax reliefs for traders and claim capital allowances for furniture, fixtures and fittings. The profits from a furnished holiday lettings business also count as earnings for pension purposes.

Read More

If you sell a property that has not been your main residence throughout the period that you have owned it, you may need to pay capital gains tax if a gain arises on the disposal of the property. This may be the case if you have an investment property, such as a buy-to-let or holiday let, or a second home.

Read More